How Much Does Debt Cost Worksheet Answers

When youre done answer the following questions. Is there a minimum finance charge on either of the major credit cards.

Worksheet Answer Key For What Is The Real Cost Financial Literacy Worksheets Literacy Worksheets Consumer Math

One way to manage all your debts in one place is through debt worksheets.

How much does debt cost worksheet answers. Two major credit cards. 45 minutes for small group discussion of the material from the Viewers Guide and for completing the handout How Much Does Debt Cost 45 minutes for class discussion of the student handouts. 8-3 How Much Does It Really Cost.

Rafael wants to buy a new CD player that costs 450. Bill with a 250 deductible and 8020 coinsurance with a 5000 limit on out-of-pocket costs a consumer would pay 1250 250 deductible 1000 coinsurance. We dont intend to display any copyright protected images.

How Much Does Debt Cost. Have students calculate the total cost of items bought on credit and what the eventual cost of those items will be if only the minimum payment is. Thank you for visiting calculate your debt to income worksheet answers.

And One credit card from a department store. If you have an older child tell her that the school clothes you bought her cost 13275 with a 75 percent sales tax rate and tell her to figure out the total amount you spent. What is the grace period on the credit card from the local department store.

If so how much is it. We hope you can find what you need here. Students will read a sample disclosure statement and understand the fees limits finance charges grace periods APRs etc.

Although 55 million Americans pay off their credit card balances in full each month 90 million Americans carry an average of 8000 in debt from month to month. If so how much is it. We have provided ten worksheets that will help you in managing all your debts.

Amount 2384 358 tip 2742 So the amount of money that Mr. This exercise will give you a chance to shop for and compare the costs and features of three credit cards. Answers 1 Zach would pay the 25 2275 since it is larger.

7630 average debt 12 months 636 debt per month. Does the first major credit card charge a fee for late payments. You may also see Swot Analysis Worksheet Examples.

Now add that monthly debt to your average monthly mortgage payment of 84025 to get your total debt owed per month. When debt does not build net worth and is the result of poor spending and budgeting habits say a flat-screen tV you cannot afford its bad debt. If so how much is it.

Bad debt doesnt build wealth or our earning power. 358 So the tip amount is 358. 910 025 2275 2 154 months of payments 12 months 12 years 10 months 3 Month 91 371 4 Add interest paid for months 112 16445 minimum payments for months 112 25965 6333.

Besides honing math skills these kinds of activities help kids understand the importance of valuing money. Using the attached form research the costs and features of. I now advise people to save 1000 quickly then switch to the 7525 method until your Emergency Fund is funded with one month worth of expenses then switch to either 100 debt reduction or whatever ratio youre comfortable with.

A discount is an amount of money subtracted from the original price of an item. Assign students a group or partner to complete the activity. Using the credit card statement provided have students answer the questions attached to the statement.

Amount 2384 x 015 15 changed to a decimal 3576 approx. Credit card costs and features can vary greatly. Students can take a close look at a credit card statement and see what kind of information it contains.

If you found any images copyrighted to yours please contact us and we will remove it. Kelly left on the table was 2742. Simple Interest Worksheets With Answers Explain to students that the answer would be 2862 because 318 x 9 percent is the same as 318 x 009 which equals 2862.

Worksheet 3-1 review your answers to the trueFalse quiz with the key below. Debt worksheets can help you categorize your debts which make it easier for you to pay. Using the credit card statement provided have students answer the questions attached to the statement.

American Consumer Credit Counseling ACCC is a nonprofit debt management company that provides consumers with personalized counseling and solutions for consolidation of debtSince our founding in 1991 ACCCs consolidated credit counseling services and debt assistance programs have been helping consumers consolidate debts and regain control of their finances. 20 of 5000 and the insurer would pay. Teacher Instructions Hand out the student activity sheet and sample disclosure form.

For example 300 of consumer debt payments with a 2600 net income produces a consumer debt-to-income ratio of 12. Read the scenario and analyze data to answer the problems. What Does Your Statement Tell You.

8-3 How Much Does It Really Cost. You calculate a debt-to-income ratio by adding up all monthly consumer debt payments and dividing this total by total monthly net income. Explain to students that they would have to pay this amount of interest in addition to repaying the principal the amount of.

Hidden Costs Of Credit Worksheet Answers 2 3 Credit Walls

Make A Personal Budget With Microsoft Excel In 4 Easy Steps Personal Budget Budgeting Money Budgeting

Free Printable Debt Thermometer Debt Payoff Debt Payoff Printables Debt Relief Programs

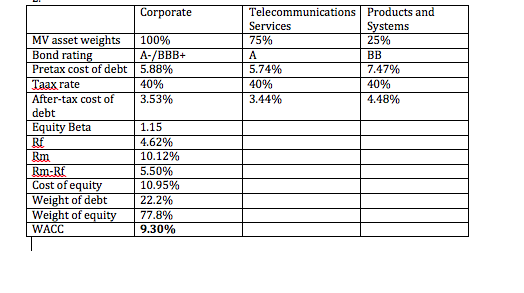

Please Estimate The Segment Waccs For Teletech Se Chegg Com

Practice Applying Compound Interest Formulas With These Word Problems Word Problems Simple Interest Financial Literacy Worksheets

Monthly Budget Worksheet For Economics Student Handouts Budgeting Worksheets Economics Middle School Economics

Student Loans Help Cover Costs For Higher Education And Are Paid Back Over A Period Of Time Paying Ba Student Loans Student Loan Infographic Student Loan Help

My Number One Favorite Debt Repayment Calculator Ask Allea Millennial Money Answers Debt Repayment Paying Off Student Loans Debt Repayment Calculator

Fun Free Debt Tracker Printables And Ideas To Help You Stay On Track To Pay Off Your Credit Cards Student Loans Debt Tracker Money Management Student Loans

Percents Sales Tax Tips And Commission Notes Task Cards And Worksheet Money Math Money Worksheets Money Math Worksheets

Wealthy Habits Cost Of Debt Worksheet

Explore Our Sample Of Debt Repayment Budget Template For Free In 2020 Budget Template Debt Snowball Worksheet Excel Budget

Practice Applying Compound Interest Formulas With These Word Problems Word Problems Simple Interest Financial Literacy Worksheets

Youth Ministry Budget Template Fresh Bud Ing For Your First Apartment Free Bud Worksheet Budget Spreadsheet Template Budget Spreadsheet Budgeting Worksheets

Easy Family Budget Spreadsheet Family Budget Spreadsheet Budgeting Money Budgeting

Questions And Answers Financial Accounting Theory Practice Notes Payable Debt Restructuring Qu Financial Accounting Financial This Or That Questions

Dave Ramsey Debt Snowball Spreadsheet Dave Ramsey Debt Snowball Spreadsheet Debt Snowball Debt Snowball Spreadsheet

Free Printable Debt Snowball Worksheet Pay Down Your Debt Debt Snowball Worksheet Budgeting Money Budgeting